Finance app development is on the rise, especially in the digital transformation of FinTech. The total revenue of this industry was $1.41 billion in 2022. With an impressive annual growth rate of 8.31%, this figure may reach up to $2.89 billion by 2029.

How can finance apps become that popular? We have to consider their numerous benefits. Thanks to the apps, you can manage your finances and conduct secure transactions. The insights you get from the apps also help you make informed decisions. The demand for secure financial solutions is increasing, highlighting the critical finance apps.

Looking to develop a powerful finance app? This article will help by digging into finance app development. You will explore the types, key features, processes, monetization opportunities, and everything about the apps. Keep scrolling down to learn!

What is a Finance App?

A finance app is an app built to manage finances. You can use it to track your expenses, make strategic investments, and handle finance-related jobs.

A financial app helps users save their money and even generate additional income. Another goal of finance app development is to improve personal budget allocation. So, the app is all about finance management. It can assist you with those tricky tasks thanks to the following functionalities:

- Expense Tracking: Finance apps help users monitor their daily spending. Thus, they can control their finance better and stay on track with their budgeting goals.

- Investments: Finance apps offer tools to manage investments. They help users track their investments by asset class or account. Users can also view the asset allocation easily.

- Saving Plans: Those apps help users create their own saving plans so they can follow them strictly. This task also involves their investment portfolios. Thanks to this assistance, users can reach their financial goals without too much effort.

- Tax Payments: The apps help users gather and classify tax information easily. This way, they can reduce the risk of errors and ensure compliance with regulations.

Benefits of Finance App Development

Finance apps are increasingly popular due to their various benefits. Generally, they come into play whenever you have trouble with your finances.

Expense Monitoring

Traditional banking means users have to visit the bank and interact with the staff to access services. Financial application development was born to eliminate this inconvenience. With the app in their hand, users can get actionable insights easily. The app sends spending alerts and records their spending patterns. Then, they can correct their spending habits to achieve their financial goals sooner.

Reports & Statistics Gathering

Finance apps break down your spending into different categories. Users can then understand where their money goes. The apps also generate detailed reports to help them closely monitor your spending. Moreover, the reports come in charts or graphs, making financial analysis easier. Based on the reports, users can find areas to cut costs and optimize budgets.

Integrations

Users may have multiple cards. One of the best things about finance apps is that they integrate with linked bank accounts and cards. Users don’t have to deal with complex login processes. Instead, they will receive instant notifications and be able to monitor their spending effortlessly.

Saving Plans

Everyone wants to save their money for specific purposes. With the help of finance mobile app development, users can build better financial habits. Finance apps track progress and offer insights into their spending patterns. This way, they can identify areas for financial improvement.

Payment Reminders

Late fees lead to many consequences, including fines. So don’t let them happen! Finance apps help avoid late fees by sending timely reminders for upcoming bills and payments. Thus, you can meet financial obligations on time. In this case, you will also manage your finances better.

Types of Finance Apps

There are multiple types of finance apps. We will divide financial application development into two categories: simple and complex. Each serves specific tasks and has different features.

Simple Finance Apps

Casual users just need finance apps to handle basic financial tasks. In this case, simple financial app development comes into play. The apps can be:

- Budget Planners: Users need a budget planner to track their income, savings, financial goals, and expenses. The best thing is that they can manage their money in an organized way.

- Spending Trackers: The apps monitor expenditures in real time. Then, users can access their spending insights. They need these reports to control their finances better.

- Peer-to-Peer Payment Apps: These apps enable users to send money to each other. They do it by searching phone numbers, usernames, or email addresses. All those steps just require a few seconds.

- Gamified Money Apps: Gamification is about using game-like features in a non-gaming platform. So, a gamified money app performs the same tasks as a regular finance app. Yet, its interesting features make finances more engaging.

- Banking Apps (Basic): A basic banking app has simple features like balance checks, bill payments, and fund transfers. They are enough to manage your finances.

- Real-Time Spending and Tracking Apps: Finance apps provide users with instant updates on their transactions. They will then have a clear and up-to-date view of their financial activities.

Complex Finance Apps

Users may also have sophisticated needs like investment or financial forecasting. Hence, they look for finance apps with advanced features. Some apps belong to this category are:

- Investment Apps: These apps help users invest in cryptocurrencies, mutual funds, stocks, and other assets. Many offer advanced analytics to optimize investment strategies.

- Financial Forecasting Apps: Users also want to forecast future income and market trends. To serve this purpose, finance apps use past financial data, current numbers, and other relevant information.

- Financial Advice & Consultation Apps: Finance apps can provide personalized recommendations tailored to users’ income and goals. Users can choose between professional consultants or AI assistants. Since AI is now popular in FinTech, AI-driven insights have become more widespread and reliable.

- Personal Finance Apps: With these apps, you will have an all-in-one financial management tool! They integrate budgeting, bill management, and expense tracking into a single place. Go for them, and you will stay organized without handling too many tools!

- Custom Finance Apps: These feature-rich platforms cater to advanced financial planning. For example, they help with investment tracking, analytics, and tax calculations.

- Banking Apps (Advanced): Banking apps can go beyond basic transactions. Users choose them for financial goal setting and credit score tracking. Some apps can even help manage loans. Together, they contribute to a seamless banking experience.

Read more: Mobile Banking App Development: A Complete Guide

Key Features of Financial App Development

Finance apps can be simple or complex. Hence, their features will be different. This session explores the essential features that define a finance app. Those features focus on security, usability, and tailored financial management.

Core Features in Finance App Development

App development for finance ensures the final product meets users’ basic needs while providing a reliable financial management experience. The following core features set the foundation for a finance app:

- Account Integration: Finance apps connect bank accounts, credit cards, and financial platforms to create a unified financial view. Money management will be easier because the app syncs all transactions in one place.

- Real-Time Tracking and Spending: Users can receive instant updates on their transactions and spending habits. This way, they will easily monitor their budget and make smart financial decisions.

- Security Measures: Security is essential in finance apps. Security features like data encryption, biometric access, and secure login aim to protect user information.

- Alerts and Notifications: Users receive timely reminders for due payments, unusual spending, and low balances. Finance apps also send investment updates to keep users informed.

- Expense Categorization and Data Visualization: Finance apps automatically organize expenses into different categories. After that, they present financial data through easy-to-understand charts or graphs. Hence, users can track their spending more efficiently.

Advanced Features in Finance App Development

Complex apps come with more features to add personalization and sophistication. Users will find these features engaging:

- AI Algorithms for Financial Advice: AI-powered tools like AI chatbots offer personalized financial recommendations based on user data. Customer support becomes more effective because users can get help 24/7 and instantly.

- Investment Management Tools: Finance apps help users monitor, manage, and optimize their investment portfolios with real-time insights. Users can also track performance and market trends.

- Goal Setting: Users may have goals like paying off debt or planning for a vacation. Finance apps help them define and track their goals with progress updates and guidance.

- User Profile Customization: Users can change the app features, themes, and financial suggestions based on their behavior and preferences. This personalized experience ensures finance apps can adapt to specific goals and needs.

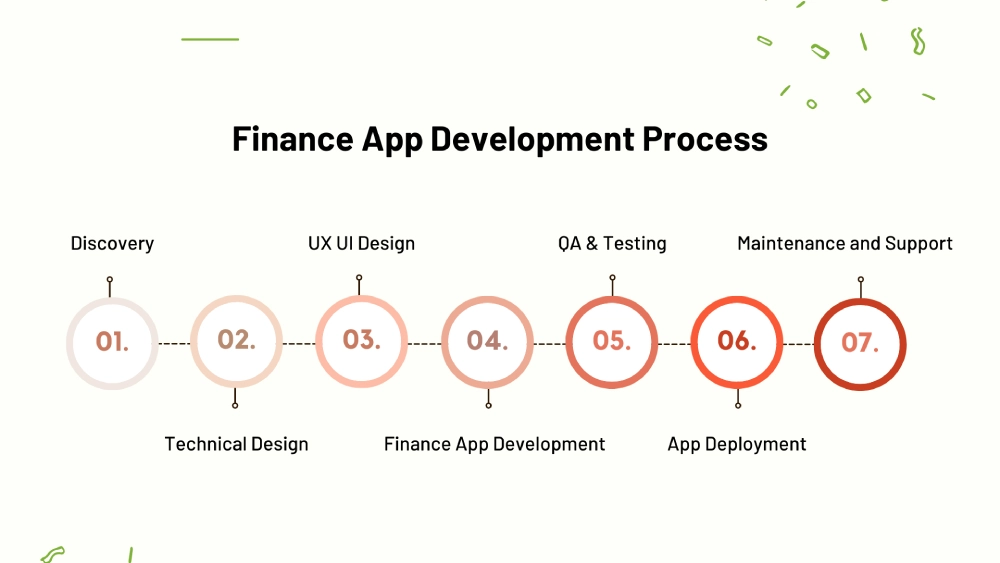

Finance App Development Process: A Step-by-step

Finance app development requires a structured approach. Each stage in the process plays a vital role in creating a successful solution.

1. Discovery

The first stage in finance mobile app development sets the foundation for the journey ahead. Here is what you need to do:

- Market Research: If you want to stand out in the market, study the market first. You can understand market demands and find your opportunities by analyzing industry trends, competitor apps, and user behaviors.

- Target Audience: Users have diverse needs. So, define your target audience and learn their needs. This way, your finance app can meet their pain points and preferences.

- Requirements Gathering: After research, create a detailed list of functional and business requirements. These factors are included in the app.

- Risk Assessment: Security, adoption, and compliance risks may arise at any time. Thus, you should identify potential issues and plan strategies to deal with them.

- Project Scope & KPIs: Your project requires clear KPIs. You should also set costs, time, and resources to achieve your project goals.

2. Technical Design

This financial app development stage turns your idea into a viable plan. You need to handle the following tasks:

- Tech Stack: Decide between cross-platform and native app development. Generally, a cross-platform finance app is faster and easier to develop, while a native app (iOS or Android) has unique platform-specific features. After choosing the app type, select the best programming languages, tools, and frameworks.

- MVP (Minimum Viable Product): An MVP has essential features. When building the MVP, you focus on core functionalities to test early users. Based on their feedback, you can refine the app and enter the market successfully.

- Cybersecurity: Implement strong security measures like multi-factor authentication and encryption. You need them to protect sensitive financial data.

- Scalability & Availability: Design your app for high performance. Your app doesn’t work for a moment. Hence, ensure it can handle increased traffic and remains ready for future growth.

3. UX UI Design

A good finance app isn’t just functional! It should be easy to use and visually appealing. The tasks below will ensure your app can keep users engaged!

- UI/UX Design: Create a clean, user-friendly interface with simple navigation. You should prioritize usability here. It means every feature must be accessible with minimal effort.

- Personalization: Give your users a chance to personalize their app experience by adding customizable features, such as themes or settings. A tailored experience will make your app more enjoyable.

- Brand Alignment: Match the app’s colors, fonts, and style with your company’s brand identity. Also, ensure consistency with your branding guidelines.

- Accessibility: Confirm your design supports accessibility features. Everyone should be able to manage their finances using your apps.

4. Finance App Development

Your finance mobile app development starts to take shape here. The app requires back-end development, interfaces, and integrations to work.

- Back-end Development: Create a robust back-end to manage financial data securely and efficiently. Financial app developers need to integrate your app with third-party services like payment gateways, GPS, and authentication.

- Role-Specific Interfaces: Develop user interfaces based on roles. Admins and end-users should have different experiences.

- Third-Party Integrations: Integrate your app with external services and core finance systems. These integrations enhance convenience and functionality.

5. Quality Assurance (QA) and App Testing

You must make sure your app is secure and stable. This testing stage includes:

- Comprehensive Testing: Conduct various tests to confirm that your app is in the best condition. For example, performance testing checks its speed and reliability, while usability testing ensures a smooth user experience.

- Bug Fixing: Detect and fix bugs immediately. Otherwise, errors will lead to severe damage.

- Continuous Testing: Test the app throughout development to catch potential flaws early. Regular checks also help maintain smooth operations.

6. App Deployment

Once testing is done, your app will be ready to access users. A smooth deployment stage involves these steps:

- Launch Preparation: Submit the app to the Apple Store and Google Play. Remember to follow guidelines for a smooth release.

- Knowledge Transfer: Train app administrators and give them the necessary documentation. They should know how to manage, troubleshoot, and update the app properly.

- App Store Optimization (ASO): Optimize the app’s title and description. This optimization step helps increase visibility and attract more downloads.

7. App Maintenance and Support

Launching your app is just the beginning. You need ongoing maintenance and support to keep it running smoothly.

- Continuous Maintenance and Updates: Regularly monitor the app for bugs and performance issues. You should also update it to enhance functionality.

- Performance Optimization: Add new features and integrations based on user needs. Besides, your app should align with evolving industry standards and security protocols.

How to Keep Your Financial App Legally Compliant?

The finance sector is an ideal target for hackers. From 2019 to 2023, security breaches in financial institutions rose by over 330%. Hence, data security is essential.

Unfortunately, this task is challenging. Financial apps development may face several compliance risks, such as:

- The apps have to keep up with regulatory compliance changes.

- You must ensure anti-fraud compliance to detect and prevent fraud.

- Managing cross-border operations is tricky because it involves different regulations in various countries.

- The costs of compliance while staying competitive are high.

Despite the challenges, you have to keep your financial app legal. It’s not just a legal necessity. Instead, your business and customers can benefit from the compliance. For example, as you ensure information security, you can protect your user data and prevent leakage. The safe environment then increases customer trust.

So, what regulations to comply with? At least, you must bear these laws in mind:

- Financial Industry Regulatory Authority (FINRA): FINRA focuses on investment apps. You obey it to ensure the security of the apps.

- ISO/IEC 27001: The international standard helps protect valuable data. This certification shows your customers and partners that their information is safe.

- Payment Card Industry Data Security Standard (PCI DSS): This security standard protects debit and credit card transactions. By ensuring safe handling of payment information, it prevents data breaches and fraud.

- General Data Protection Regulation (GDPR): Applied to EU citizens, GDPR regulates data security and privacy for personal information.

Emerging Technologies in Finance App Development

The FinTech industry is evolving rapidly. This impressive growth comes from cutting-edge technologies that enhance security and user experience. The innovations below have shaped custom finance app development.

Artificial Intelligence (AI)

AI is changing the game! You can use this technology to stop fraud by spotting suspicious activities. Smart chatbots and virtual assistants also help by making customer support easier. Moreover, AI automates routine tasks to reduce errors. The rapid and accurate processing of data offered by AI systems improves overall efficiency. In the end, digital transactions can be quicker and safer.

Cloud Computing

Cloud computing offers scalable solutions for data storage and processing in app development for finance. This way, you can ensure secure data sharing and smooth maintenance. Besides, cloud computing enables accessible, cost-effective infrastructure. Hence, you can build powerful finance apps without expensive hardware. That’s how this technology drives digital transformation!

Machine Learning

Machine learning algorithms can identify patterns and detect anomalies. You need such powerful tools to prevent fraud and optimize financial processes. But that’s not all! Machine learning also offers personalized insights and recommendations. Ultimately, this technology can improve the personal finance app development experience.

Blockchain

Struggling with older financial structures? Then blockchain is what you need for finance app development. Unlike traditional systems, this technology offers a more secure and transparent way to handle payments. The best thing is that it lowers transaction costs because you can reduce errors and paperwork.

Open Source & SaaS

Building finance apps is now easier than ever, thanks to open source technologies and SaaS platforms. Cloud-based finance solutions will help you remove the need for complex infrastructure. Plus, SaaS solutions offer ready-made tools. Developers can use them to speed up development while keeping the costs low.

Monetization Strategies for Finance Apps

How do finance apps make money? Finance apps can be profitable! There are several ways to generate revenue while keeping your users engaged. The strategies include the following:

Data Monetization

With the power of AI, finance apps can provide valuable insights from data analysis. Based on the reports, you can optimize your marketing campaigns as you target the right audience. Another strategy is to sell anonymized insights to data analytics companies. Yet, remember to ensure user security and privacy.

In-App Purchases

Users can buy premium features, customizations, or even remove ads for a better experience. This model works well because it gives users control. They can enjoy the free version and choose to pay for extras as they find value in them. It’s an excellent way for free finance apps to generate revenue without upfront costs!

In-App Ads

Another way to monetize financial mobile app development is through in-app ads. These ads are relevant to the services your app offers. Target ads play a vital role here because they improve user engagement and ad relevance. With the right balance, the ads can boost revenue without annoying the user experience.

Subscription Model

In this model, users pay a fee to access premium features or exclusive content. Many finance apps offer a free trial first so that users can explore the benefits before committing. Once they recognize the value, they are more likely to pay. So, this model builds long-term engagement while keeping your app profitable.

Affiliate Marketing

One interesting way to earn revenue in financial application development is through affiliate marketing. You can partner with trusted brands to promote relevant products or services. When users purchase your app, you will earn a commission. This strategy is perfect when the promotions align with your app’s features. For example, your finance app can recommend insurance or investment tools.

Freemium Model

This model combines the benefits of paid features and in-app advertising. More specifically, your app may offer basic features for free. If users want to access a complete feature set or advanced tools, they can upgrade by paying a monthly fee. With this model, they get value upfront, and those who need more are happy to pay.

Cost and Time in Finance App Development

How much does it cost to develop a financial app? Before answering this question, let’s first consider the factors that affect app development costs. These factors are crucial for understanding the overall price.

Factors Affecting Finance App Costs

The cost depends on various factors, such as:

- App Complexity: Basic features like expense tracking and manual data input are easier to build. Some don’t even have card integrations. With the development time frame of 3 to 6 months, such projects require $35,000-$75,000. On the other hand, you need more than 6 months to develop features like AI, bank integrations, advanced security, and real-time updates. The cost ranges from $80,000 to $200,000.

- Core Features: Simple apps come with simple features. For example, they just require a user profile, calculators, notifications, and expense categorization. Meanwhile, complex apps have smart budgeting, reporting, and advanced security. They also include bank/payment system integrations. So, if you plan to develop complex apps, you will need more time and budget.

- Team Location and Expertise: The development team location affects the time and cost. Outsourcing app development to teams based in countries like Vietnam, China, or India will charge you less. Consider the team’s expertise, too. Experienced teams require a higher rate. Yet, they will impress you with their high-quality work.

Want to save your money? There are several ways to cut down on finance app development costs. You also need to allocate your resources strategically while trying to minimize the development budget.

Reducing Finance App Development Costs: Key Strategies

Here are some budgeting and resource allocation tips:

- MVP Development: An MVP allows you to develop a finance app with only essential features. This approach reduces initial costs. Moreover, as you test early users first, you can easily refine your app before investing in full-scale development.

- Investment in UX/UI and Security: Robust security measures help protect user data while a seamless user experience ensures users stay engaged. With design and security investments, you can maintain trust and engagement.

- Expert Help: You can partner with a FinTech app development company. Your partner has the expertise, skills, and experience to handle your project without breaking the bank.

- Ongoing Maintenance: Successful finance apps require continuous updates. You have to consider budgeting for long-term maintenance to ensure the app performance.

To get accurate cost estimates and explore the best development strategies, contact a FinTech app development expert like Saigon Technology. We are ready to help you optimize your budget and time. Contact us!

Start Your Finance App Development Journey with Saigon Technology

Finance app development companies can assist you with your challenging journey. The key is to choose the right partner. Saigon Technology is proud to be your consideration. Here’s why you should select us!

- Expertise in Finance Development: We have years of experience in the industry. Choosing us, you can build secure and scalable finance apps. Feel free to ask our experienced financial app developers for everything you need, from digital wallets to banking solutions.

- Tailored Solutions: We try to understand your needs. Before starting any project, we will first learn about your requirements. They act as guidelines for the whole journey. Whether you are launching a startup or scaling an enterprise, our flexible development models and exceptional finance app development services will fit your goals.

- Cutting-Edge Technology: Your finance app can be both secure and innovative with our cutting-edge technologies. We use AI, cloud infrastructure, and blockchain to ensure your app’s best performance.

- Regulatory Compliance: As mentioned above, your app must comply with regulations. With us, your app will meet all finance regulations. We also guarantee risk management and robust security.

- Agile Development Process: We choose agile approaches to ensure fast, collaborative development. This way, your app can access the market quickly without compromising quality.

- Proven Track Record: We have a portfolio of successful projects and satisfied clients. Browse it to see how far we have gone. Our results speak for themselves.

- Ongoing Support: We provide continuous support and maintenance. Our dedication ensures your app can stay secure and scalable as your business expands.

Contact us now to get a free quote!

FAQs

What is finance app development?

Finance app development is about building mobile or web apps for banking, payments, investing, and budgeting. Finance apps focus on user needs while ensuring compliance, scalability, and security.

How to develop a financial app?

You can develop a successful financial app by following these steps:

- Step 1: Discovery

- Step 2: Technical design

- Step 3: UX UI design

- Step 4: Finance app development

- Step 5: QA and app testing

- Step 6: App deployment

- Step 7: Maintenance and support

How long does it take to develop a finance app?

Finance app development time depend on these factors:

- App complexity

- Core features

- Team location and expertise

- Time frame considerations

Typical Time Ranges (General Estimates):

- Simple Finance App: 3-6 months

- Medium Complex Finance App: 6-12 months

- Complex Finance App: 12+ months

Get a precise timeline for your finance app project. Contact Saigon Technology today!

How much does it cost to develop a financial app?

If you plan to develop a simple app, the cost will be somewhere from $35,000 to $75,000. Meanwhile, the cost of developing a complex app with advanced features is between $80,000 and $200,000.

What are the key features of a finance app?

Finance app features are numerous, with the following being the most common:

- Secure user authentication

- Investment management

- Real-time transactions

- Budgeting tools

- Financial dashboards

- Expense tracking

- Compliance with financial regulations

- Payment gateways

How does Saigon Technology ensure the security of my finance app?

We deliver secure financial apps development solutions by implementing these measures:

- Data encryption

- Secure payment gateways

- Regular security audits

- Compliance with financial regulations