In the world of financial technology, fintech outsourcing is vital. From banking to fintech development outsourcing services, we’ll explore the benefits. We’ve got insights to boost your business. Discover how it can transform your business.

Market and Trends in Fintech Outsourcing

The fintech industry is growing rapidly, with the global market expected to rise from USD 340.10 billion in 2024 to USD 1,152.06 billion by 2032. This represents an annual growth rate (CAGR) of 16.5%.

Key drivers included increasing digital financial services and big data integration. Continuous innovation within the sector drove growth as well.

In 2024, the U.S. fintech market reached about USD 4.10 trillion. It is expected to grow at an annual rate of 11.2% from 2025 to 2034. Digital payments continue to lead this growth, driven by the expansion of e-commerce and mobile banking services.

Fintech trends

Several trends shaped the financial tech outsourcing landscape. Embedded finance, or Banking-as-a-Service (BaaS), grew a lot. The global embedded finance market was valued at USD 104.8 billion in 2024 and is expected to grow at an annual rate of 23.3% (CAGR) from 2025 to 2034.

This trend lets non-banking companies offer financial services via APIs. It enhanced customer experience and loyalty. The rise of digital-only neo-banking platforms impacted the market. Technology-driven insurance solutions (InsurTech) met diverse customer needs.

Digital transactions became common, boosting financial technology partnerships. Innovations in AI, blockchain and biometrics technology further boosted market growth.

Benefits of Fintech Development Outsourcing

Do you need help with costs and deadlines? Financial technology development outsourcing is your solution. Picture a global team of skilled developers. They handle your most demanding projects. You only focus on your business. Let’s see how outsourcing boosts your fintech journey.

1. Cost Efficiency

Let’s talk about the big issue: cost. Fintech software development can be expensive, especially for complex platforms. This is where fintech development outsourcing shines. By partnering with a provider, you can access skilled developers. This comes at a fraction of the cost of an in-house team.

Hiring full-time developers means paying for salaries, benefits, equipment, and office space. Outsourcing lets you avoid those expenses. You only pay for what you need when you need it. This frees up your budget for other areas, like marketing or investing in new technologies.

But saving money isn’t the only benefit. You’ll optimize your resources as well. Outsourcing allows your internal team to focus on their strengths, like finance expertise or marketing. This creates a leaner, more efficient development process.

2. Access to a Global Talent Pool

Imagine this: you have a fantastic fintech app idea. But you don’t have the local talent. You might need experts in blockchain or AI-powered fraud detection. For complex, long-term projects, outsourcing to an offshore software development team can be a strategic option

By outsourcing, you gain access to a global talent pool. This ensures you can find experts in blockchain, AI-powered fraud detection, and other essential skills.

This approach allows you to assemble a dedicated development team tailored to your needs. Developers from different financial markets bring useful insights. They help you build a robust solution.

Fintech development outsourcing isn’t just about filling gaps. It’s about enhancing your team with top-tier talent from around the world. This way, you drive your project to success.

3. Faster Time-to-Market

In today’s competitive fintech world, being first to market is crucial. Fintech outsourcing helps you achieve this. By partnering with an outsourcing team, you skip the slow in-house development process.

Instead of spending months recruiting and training developers, you can start immediately with an experienced partner. This saves time and lets you focus on core strategies like marketing. Your internal team can concentrate on refining your fintech concept.

4. Focus on Core Competencies

Running a fintech company is intense. You’re managing a lot: attracting new customers, following regulations, and staying ahead in innovation. It’s vital to stick to what you’re great at.

Fintech software outsourcing helps you do just that. By letting a qualified partner handle development tasks, your in-house team can focus on core strengths. These are the unique things that make your company stand out, like making a user-friendly experience or building top-notch security features. It’s like not trying to do everything yourself.

You wouldn’t design your website, manage servers, and handle support on top of everything else. Outsourcing follows the same idea. Your A-team can focus on big plans, like marketing strategies or partnerships.

Meanwhile, the experts you outsource handle the technical stuff. They make sure your product works well. This focus on core strengths gives you an edge and faster innovation. It means a more successful fintech venture.

5. Being Scalable and Flexible

Picture this: you’ve got an excellent fintech app idea. Development is going well until your product explodes in popularity. Suddenly, you need more developers. Fintech development outsourcing is perfect for this.

It’s different from hiring in-house, where scaling up can be slow and costly. Outsourcing lets you adjust your team easily. Do you need more programmers? Your partner can find them fast. If a project slows down, you can scale back the outsourced team without fuss. Being flexible is a boost for fintech businesses.

It lets you react fast to market changes and grab opportunities. No more being stuck with an extensive team when you don’t need it. Fintech outsourcing keeps costs low and team sizes just right for your project’s needs.

6. Innovation and Expertise

Let’s say you want to create a game-changing app for real estate investment. Your in-house team is competent but lacks diversity in their expertise. This is where fintech development outsourcing excels.

By leveraging a global talent pool, you gain access to modern technologies. These include AI, blockchain, and more. Imagine this: a developer in London brings deep knowledge of the European market. Then a team in Singapore specializes in blockchain technology.

At once, your project is brimming with innovation and expertise. You’ve united the finest minds worldwide. This ensures your app stands out with cutting-edge features and insights. This drives it towards unparalleled success.

Challenges Involved in Fintech Development Outsourcing

Fintech outsourcing sounds excellent, but it comes with challenges. Different time zones and cultural norms can complicate conversation. Keeping your financial data secure is crucial. We’ll discuss these challenges more in the next section. This way, you can outsource confidently.

Data Security and Regulatory Concerns

Security is a top priority when handling financial information. Fintech applications deal with sensitive data like account numbers and transaction details. Security and compliance are crucial in outsourcing. Be thorough when choosing partners. Don’t pick companies with weak security.

Ask about their security practices, encryption, and access controls. Choose partners with certifications like SOC 2 or ISO 27001. Make contracts that detail security duties, breach protocols, and termination rules. Keep conversations open about data handling and breaches.

Conduct regular security checks and tests. Stay updated on laws like the GLBA or GDPR. Make sure your partner follows these regulations. By following these steps, you can protect your customers’ data like a fortress.

Quality Control and Vendor Management

Outsourcing fintech development offers advantages, but losing control can be concerning. To ensure top quality and robust partnerships, establish clear quality checkpoints. Implement code reviews, user testing, and bug tracking as friendly checks rather than stressors.

Effective discussions are crucial. Distance can be a challenge, so maintain regular calls and video chats. Embrace feedback by both offering and accepting suggestions, as they enhance value.

Vet your vendor. Evaluate their quality processes, experience, and methods. Outsourcing is a long-term commitment; build trust and collaborate for success. Last, adopt Agile practices to be flexible and adapt to changes. This ensures continuous improvement in your fintech projects.

Intellectual Property (IP) Protection

Fintech thrives on new ideas. Are you dreaming of a mobile payment app? Or a secure blockchain solution? Those ideas are yours. You deserve the rewards. Are you worried about outsourcing taking your recognition? Relax, there are ways to protect your fintech IP.

Start with Non-Disclosure Agreements (NDAs). Think of NDAs as secrecy contracts. They keep your ideas safe before sharing anything with outsourcing teams. It’s like a padlock on your concepts. Next, involve your legal team. They craft strong IP agreements. These specify who owns what.

Did your team invent a core algorithm? The IP agreement keeps that ownership with you, even if others help with the code. Another tip: divide your project. Only give out information as needed. This limits the risks of leaks.

Conversation and Cooperation Challenges

Conversation is crucial for any project. In fintech software development, it gets more complex. You’ll handle different cultures, time zones, and working styles. These challenges are manageable. With proactive steps and intelligent strategies, you can ensure smooth operations.

Picture working with a team 12 hours ahead. A quick question in your afternoon could disrupt their night. The fix is to sync your schedules. Set times for live chats, brainstorming, and problem-solving. No one loses sleep.

A simple “yes” can mean different things across cultures. To avoid confusion, learn about your partner’s culture. Use video calls, instant messaging, and project management tools.

These help with clear, timely conversations and shared workspaces. Remember, effective conversation is interactive. Listen to your partner, encourage questions, and give clear instructions. It’s better to over-communicate than to face confusion later.

Project Management and Visibility

Handing over fintech development is like giving out your car keys. You expect results but need to see the roadmap and progress. Effective management and clear transparency are your tools here.

Fintech outsourcing needs open conversation. It’s not magic. It’s about keeping everyone informed. Use cloud platforms like Asana, Trello, or Jira. They help manage tasks, track progress, and centralize conversation.

What Can a Fintech Provider Outsource?

So, you have a big fintech idea, but making it all by yourself takes too much time and effort. That’s where outsourcing development comes in.

You can find talented people from around the world to help with everything from mobile apps to complex systems. Let’s see what you can hand off to speed up your project.

Imagine your new fintech app is a top-notch restaurant. The front end is the lovely dining area where customers order and enjoy the vibe. The back end is like the kitchen where all the action happens.

When you outsource, you get a team to build the back systems. These handle transactions, store data well, and link your app to banks or payment services. Think of APIs as the waitstaff that carry orders between the dining room and kitchen.

A good API makes sure everything in the app runs smoothly and quickly. Outsourcing this part means you can focus more on what your users see and do, speeding up how fast you can launch your app.

Your app’s front end is the part that your customers see and use all the time. Outsourcing lets you connect with skilled UI/UX designers.

They make sure your app is easy to use and looks good. It will have smooth navigation, clear buttons, and a design that shows off your brand. This matters because a great-looking app can draw in customers and beat the competition.

-

Big Data and Analytics

Data is crucial for everything in fintech. It covers safe payments and custom financial products. Outsourcing data tasks gets you the tools and know-how to manage lots of data.

Partners help you set up systems to keep data organized, safe, and easy to look at. This enables you to spot fraud fast and protect your customers. You can learn a lot about your customers’ money habits.

This lets you make products that fit their needs, like tailor-made marketing and personal finance options. In short, big data and analytics through outsourcing help you make innovative, secure, and customer-focused decisions. It’s a good deal for you and your users.

-

Business Process Outsourcing (BPO)

Running a fintech company keeps you on your toes. You innovate, follow regulations, and try to win customers. But when basic tasks like customer support slow you down, that’s where outsourcing shines.

BPO lets you pass these tasks to experts. Imagine a team that handles calls, processes loans, or manages your back office. This enables you to focus on growing your idea.

The perks are big. You use fewer internal resources and get more strategic. BPO providers offer a broad talent pool as well. This means faster services and happier customers. You will have a more streamlined business.

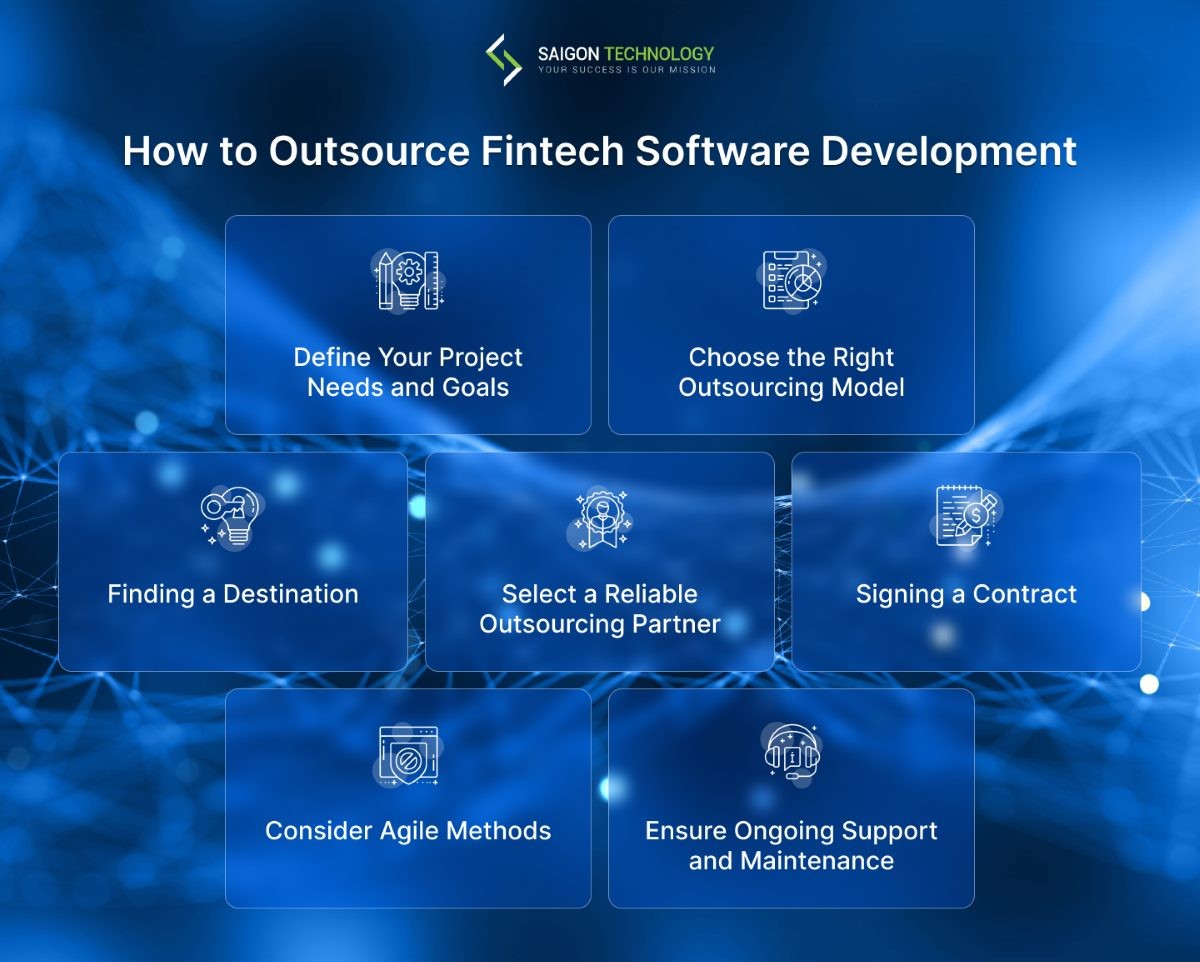

How to Outsource Fintech Software Development

Are you ready to outsource your fin-tech project? Let’s break down the critical steps to finding the perfect partner. This helps you build a smooth and successful development process.

1. Define Your Project Needs and Goals

Begin by outlining your project requirements and objectives. Understand the specific features you need and the problems you aim to solve. Consider the goals you wish to achieve. A detailed project scope will guide your entire outsourcing journey. It helps you communicate well with potential partners.

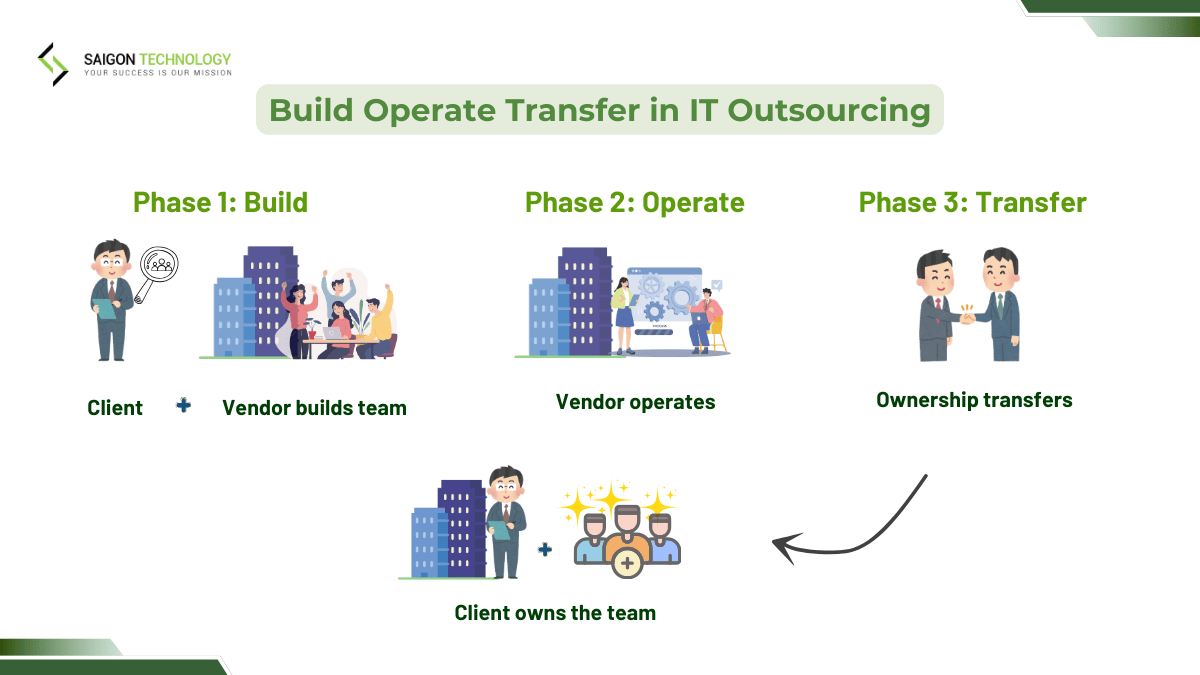

2. Choose the Right Outsourcing Model

Selecting the appropriate model is crucial. Options include onshore, nearshore, and offshore outsourcing, each with its own set of advantages. Consider factors like cost, conversation style, and time zone differences. Your choice should align with your project’s complexity and your organization’s preferences.

3. Finding a Destination

Identify the most suitable geographic location for your needs. Evaluate countries based on their tech expertise, cost efficiency, and cultural fit. Popular destinations include Eastern Europe, Asia, and Latin America. They are popular for their skilled developers and competitive rates.

4. Select a Reliable Outsourcing Partner

The success of your project depends on the partner you choose. Conduct thorough research, check references, and review portfolios. Look for partners with a proven track record in fin-tech development. They should have strong technical competence and positive client reviews.

5. Signing a Contract

Once you’ve identified a reliable partner, it’s time to formalize the partnership. A well-drafted contract should outline all project details. It should include timelines, output, payment terms, and secrecy clauses. Ensure that both parties have a clear understanding of their obligations.

6. Consider Agile Methods

Adopting Agile procedures can make you more flexible and improve your partnership. Agile practices include regular sprints and continuous feedback loops. They help in adapting to changes. This ensures that the development process remains aligned with your evolving needs.

7. Ensure Ongoing Support and Maintenance

Fintech software requires continuous monitoring and updates to stay relevant and secure. Ensure that your outsourcing partner offers ongoing support and maintenance services. This guarantees that your software remains robust and up-to-date, addressing any issues on time.

Things to Consider When Choosing an Outsourcing Partner

Fintech outsourcing can transform your project, but the right partner is crucial. You need someone who fits your strengths and shares your vision. Let’s explore what to look for to ensure your fintech venture succeeds.

-

Research and Shortlist Potential Vendors

Having chosen fintech outsourcing, your next step is to find the ideal partner. Spell out your requirements and research potential vendors. Explore their portfolios. Read reviews on platforms like Clutch and Software Outsourcing Journal. Check them out on DesignRush, GoodFirms, Glassdoor, and LinkedIn as well. Contact them to assess how they communicate and your cultural alignment.

-

Evaluate Experience, Expertise, and Technical Skills

Pick the right outsourcing partner. Check their experience, expertise, and skills. Look at their past projects. Are they similar to yours? Do they have the tech know-how? A strong team and technical skills are crucial for success.

A crucial factor in selecting a partner is their software development method. Ensure they employ a structured and proven approach, such as Agile or Waterfall. This ensures efficiency, clear conversations, and high-quality outcomes. Verify their ability to adapt methods to suit specific project requirements.

-

Assess Security Practices and Data Protection Processes

Protect your data when outsourcing fintech development. Check their security measures: encryption and access controls. Ensure they comply with industry regulations. Prioritize data security for peace of mind.

-

Consider Contact Styles and Cultural Alignment

Discussions are vital. Understand conversation styles and cultural differences. Discuss preferred contact channels. Be aware of time zones for smooth work systems.

-

Negotiate Contracts and Pricing Models

Finalize your partnership with a solid contract. Focus on pricing models and Service Level Agreements (SLAs). Negotiate fair terms, especially regarding intellectual property ownership and termination clauses. Ensure clarity and protection for both parties.

Case Study

-

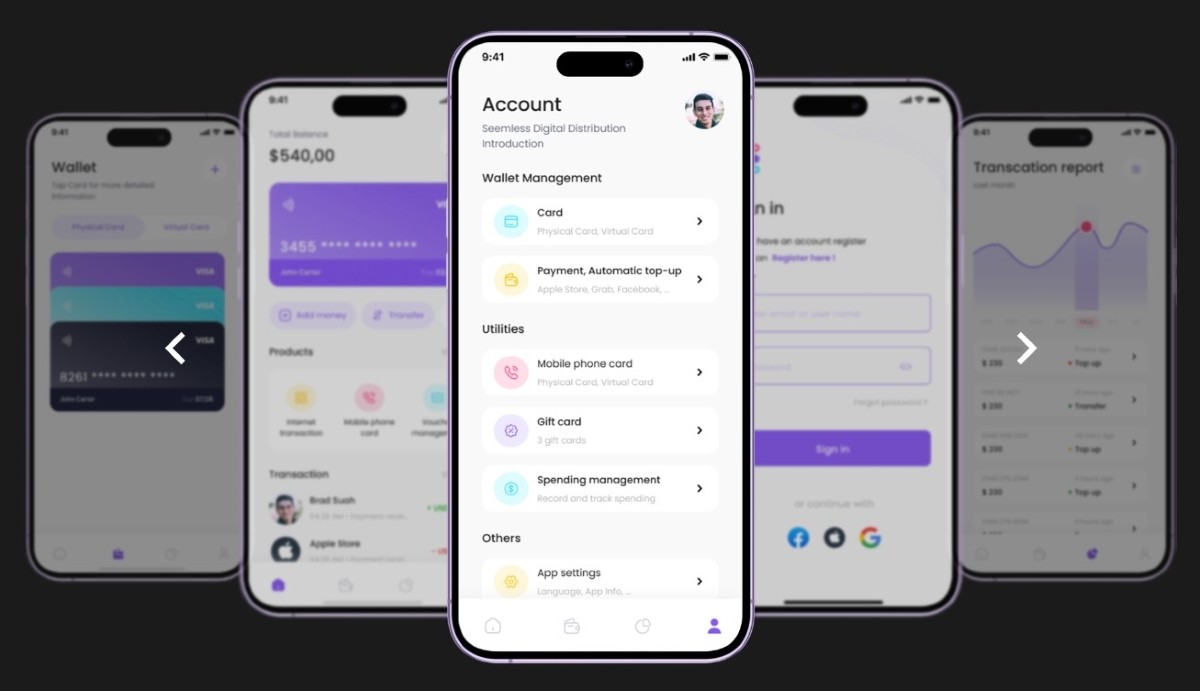

Project Introduction – Benefit for Client

Saigon Technology worked with GTW Prop Trade Pty to revamp their outdated trading platform. GTW Prop Trade Pty is a startup in FX trading. This project aimed to enhance their robustness and help them scale, positioning GTW for future growth.

-

What the Client Wanted

GTW sought a modern, dynamic web platform to replace their old desktop application. The new system needed to handle increased trade volume and complex data in real-time. This ensures seamless performance in the fast-paced fintech industry.

-

Technologies

The project utilized cutting-edge technologies, including .NET Core, Angular, and AWS. These tools were essential for developing a scalable and efficient platform.

-

Challenges

One of the main challenges was transforming the legacy desktop app. We need to change it into a robust web-based platform. It should be capable of real-time data processing. We had to ensure seamless integration with existing systems. Maintaining continuous support was critical as well.

-

Solutions

Saigon Technology established an Offshore Development Center (ODC). This helps us collaborate with GTW’s team. We used agile methods, daily reports, and sprint reviews. This made everyone flexible, and we could make rapid adjustments.

This joint effort enhanced GTW’s operations and demonstrated cost efficiency. It showed the performance boost achievable through outsourcing. The project highlighted the potential for growth and innovation in fintech.

Why Choose Saigon Technology?

At Saigon Technology, we understand how essential fintech outsourcing is for your business. We have over a decade of experience in fintech development. So, we’re a top choice for global companies. We use the latest technology and top security to meet your needs reliably.

Why pick us? We tailor our services, from banking to payment outsourcing, to fit your goals perfectly. With our global reach and vital skills, we deliver fintech software outsourcing services. And they exceed expectations.

It doesn’t matter if it’s boosting efficiency or pioneering new services. Our team is all about your success. Contact us for fintech solutions that transform your business.

Final Thoughts

Fintech outsourcing isn’t just about saving money. It’s about boosting innovation and efficiency. It lets you tap into expert skills and tech to stay ahead. Whether it’s fintech development outsourcing or improving customer service, the benefits are obvious.

The key is partnering with the right team. They can turn challenges into opportunities. It leads to better efficiency, meeting regulations, and using cutting-edge tech. As banking outsourcing evolves, stay proactive in development strategies. It keeps you competitive.

FAQs

1. How do you reduce risks in fintech outsourcing?

To lower risks, do a full risk assessment, set clear expectations, and communicate openly. Robust data security and crisis plans are crucial.

2. How do you protect Intellectual Property in fintech outsourcing?

Protecting IP is vital. Define IP rights clearly in contracts and work with partners who value IP protection.

3. What’s the difference between finance and fintech?

Finance manages money. But fintech uses tech to improve financial services like banking and insurance. Fintech is about innovation in finance.