1. Introduction

Overview of Payment Systems

Overview of Payment Systems: Payment systems are essential infrastructures that allow for the electronic transfer of funds, supporting the needs of businesses, consumers, and governments in e-commerce.

Importance of payment systems in modern commerce: Payment systems are the backbone of global commerce, enabling secure, quick, and efficient transactions that drive economic growth and facilitate online and in-person transactions.

Introduction to Stripe

Brief history and background of Stripe: Founded in 2010, Stripe is a leading online payment processor, known for its simplicity and developer-friendly features. It has grown rapidly, serving millions of businesses worldwide.

Market position and usage statistics: Stripe holds a strong market position, from small startups to large enterprises, with an extensive footprint in the digital economy.

2. Understanding the Stripe API

Introduction to Stripe API

Stripe’s API provides robust features for integrating payments, managing subscriptions, handling refunds, and more, making it a powerful tool for developers.

- Core functionalities and features: Core Functionalities and Features: The Stripe API includes tools for processing payments, managing customer data, handling disputes, and generating insights, with extensive customization options.

- Benefits of using Stripe API over other payment processors: Stripe’s API stands out for its ease of use, extensive documentation, high-level security, and adaptability, making it a preferred choice among developers.

3. Key Features of Stripe API

Stripe API isn’t just about processing payments—it’s a powerful toolkit designed for flexibility, security, and scalability. Here are its standout features:

Seamless Payment Processing

Supports multiple payment methods: credit cards, debit cards, digital wallets, and more. Accept payments from anywhere!

Handles transactions in various currencies, making it easier to expand your business globally.

Security & Compliance

Fully PCI DSS compliant, ensuring secure payment handling.

Built-in fraud prevention tools help detect suspicious transactions and protect your business.

Customization & Scalability

Webhooks allow real-time event handling—automate actions like sending confirmation emails after a successful payment.

Easily integrates with platforms like Shopify, Laravel, and WordPress, so you can tailor your payment system to your needs.

4. Pricing

Stripe’s pricing model is designed to be transparent and scalable, making it a strong choice for businesses of all sizes.

Overview of Stripe Pricing Model

Transaction fees: Stripe charges a small percentage per transaction, with rates varying based on the payment method and country.

Domestic vs. international transactions: International payments often have slightly higher fees due to currency conversion and cross-border processing.

Additional Costs: While core features are included, extra services like advanced fraud protection (Radar), invoicing, and connection for marketplace payments may incur additional fees.

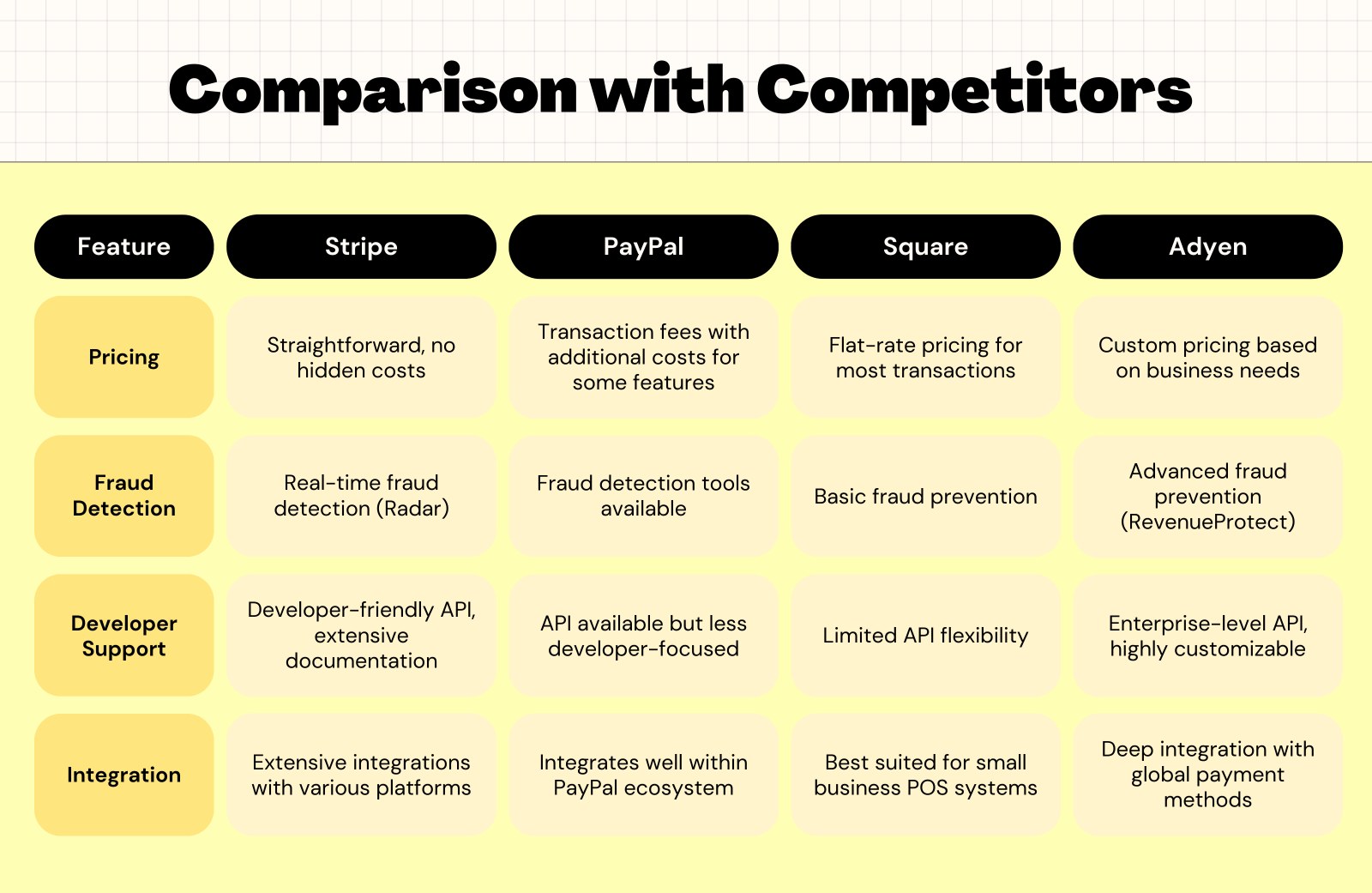

Comparison with Competitors

Competitive pricing: Compared to PayPal, Square, and Adyen, Stripe offers straightforward pricing without hidden costs.

Value-added features: Stripe’s real-time fraud detection, developer-friendly API, and extensive integration options provide a significant edge over competitors.

With Stripe, you’re not just paying for a payment processor—you’re investing in a secure, scalable, and developer-friendly platform.

5. Setting Up Stripe API

Creating a Stripe Account

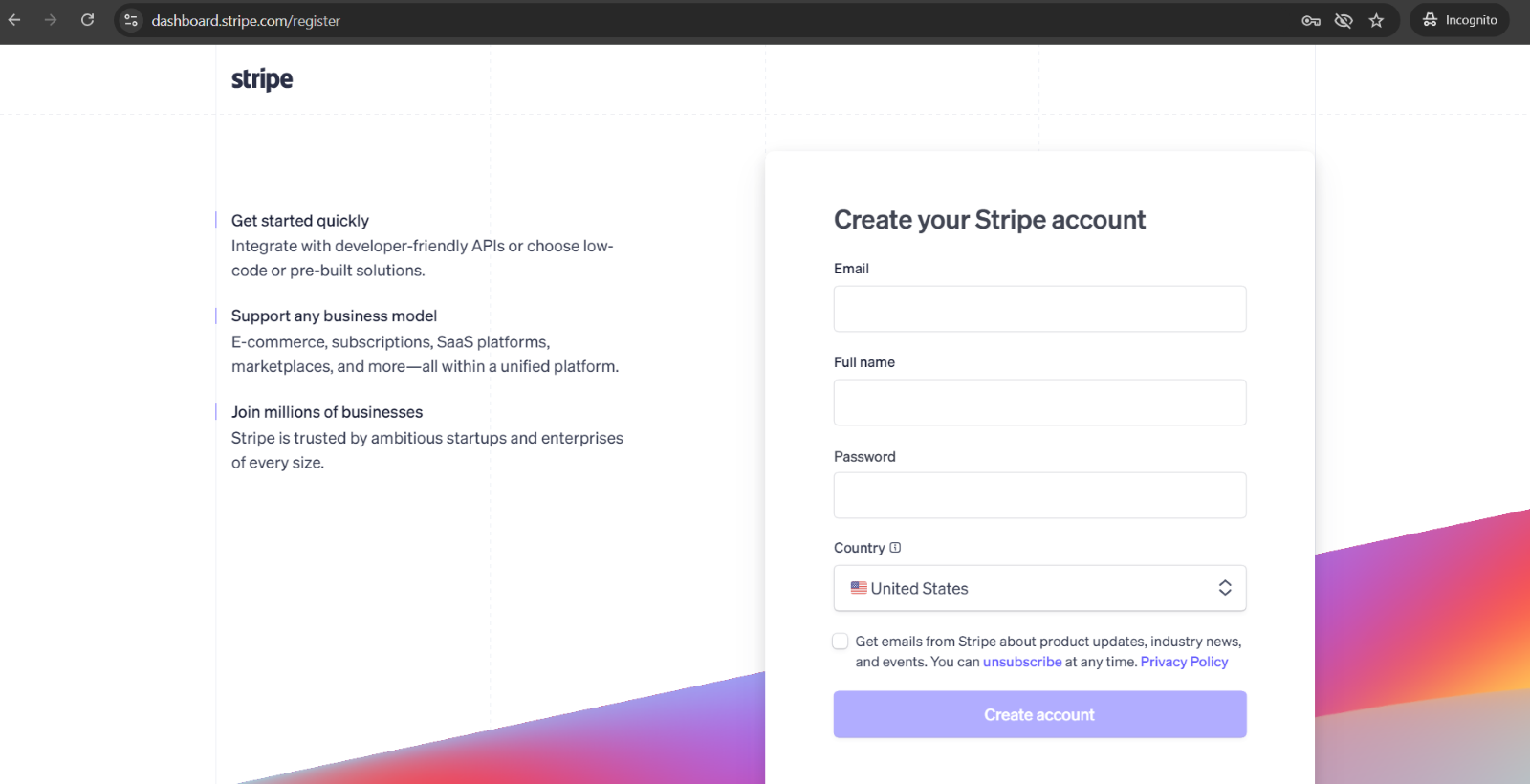

Registration process: Sign up at Stripe’s website with your business details. You’ll need to provide basic information like your email, business type, and bank details for payouts.

Create your Stripe account: https://dashboard.stripe.com/register

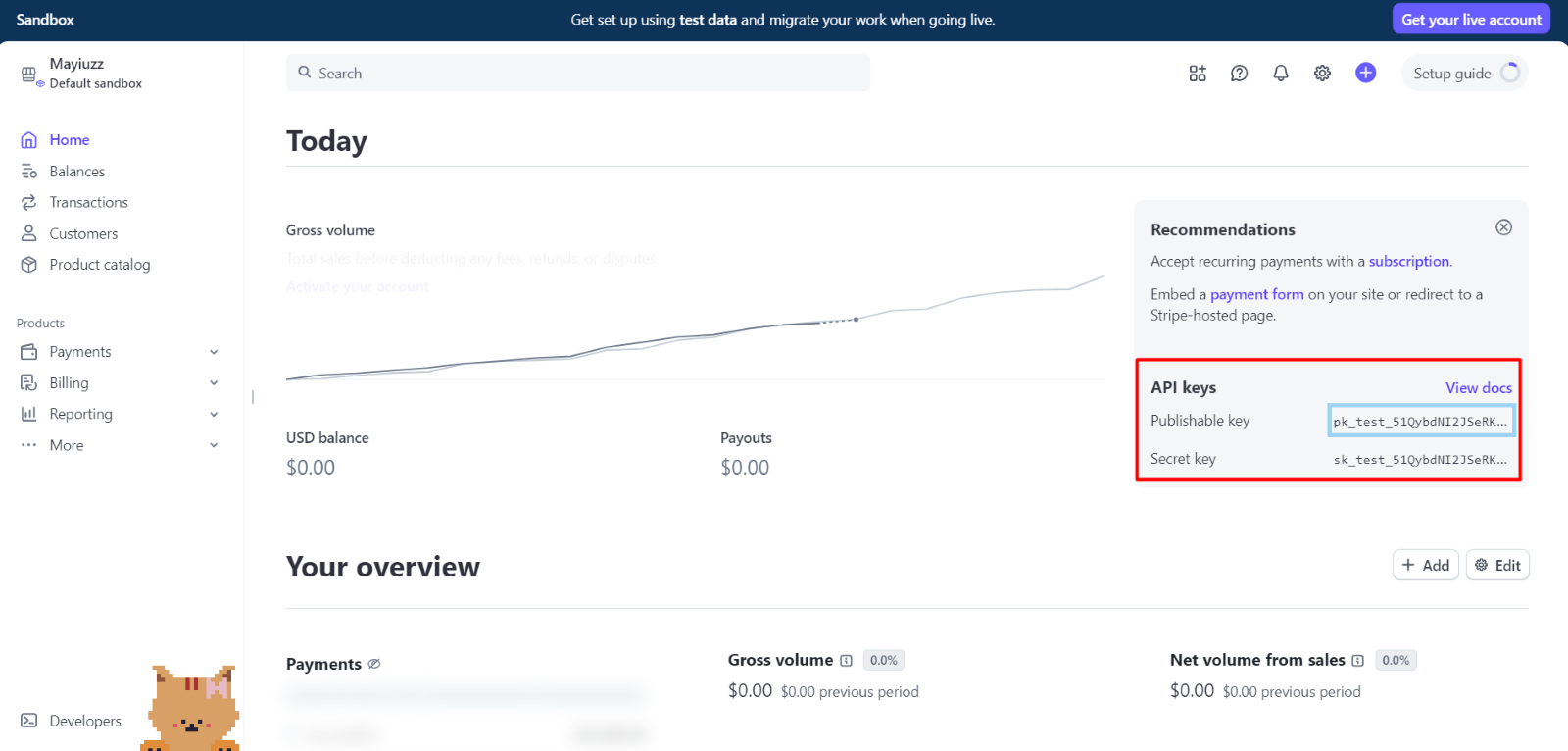

Setting up API keys: After signing up, navigate to the Developers section in your Stripe dashboard to access your Publishable and Secret API keys. These keys are essential for connecting your application to Stripe’s payment system.

6. Implementing Stripe API using Laravel

Basic Integration (for Laravel)

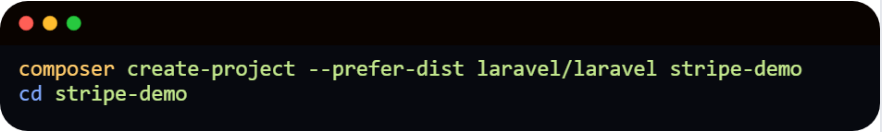

Create a New Laravel Project

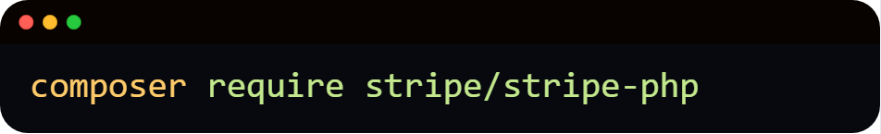

Install Stripe PHP SDK

Set Up Stripe API Keys

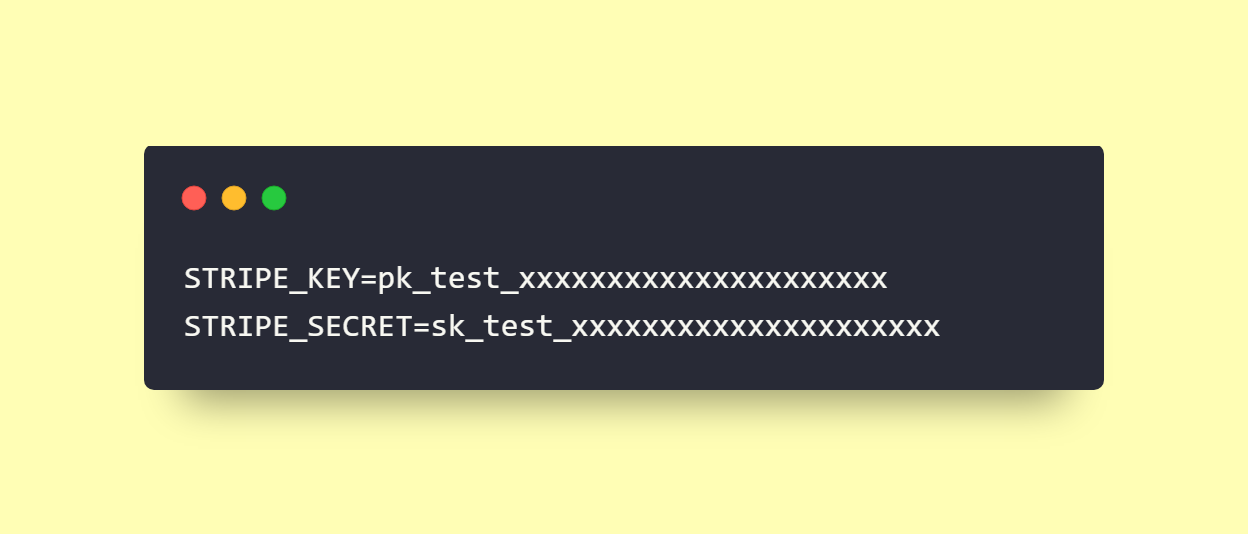

- Get your test keys from Stripe Dashboard.

- Add them to your .env file:

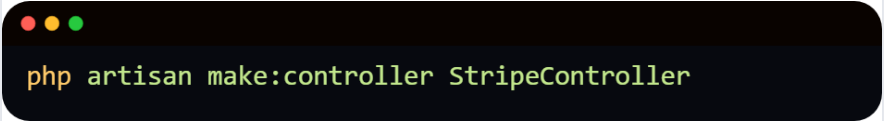

Create a Stripe Controller

- Run:

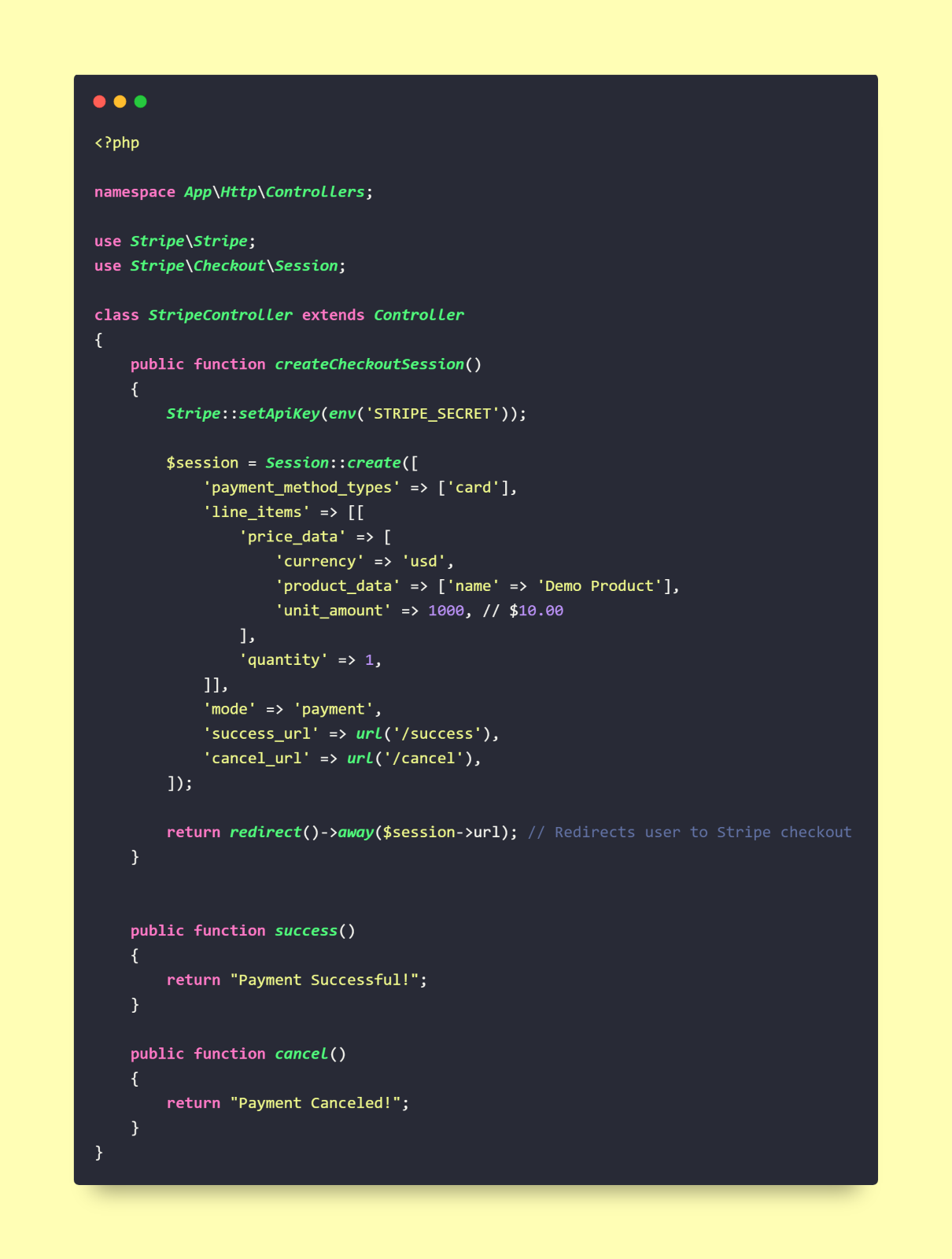

- Inside app/Http/Controllers/StripeController.php, add:

Define Routes

- In routes/web.php, add:

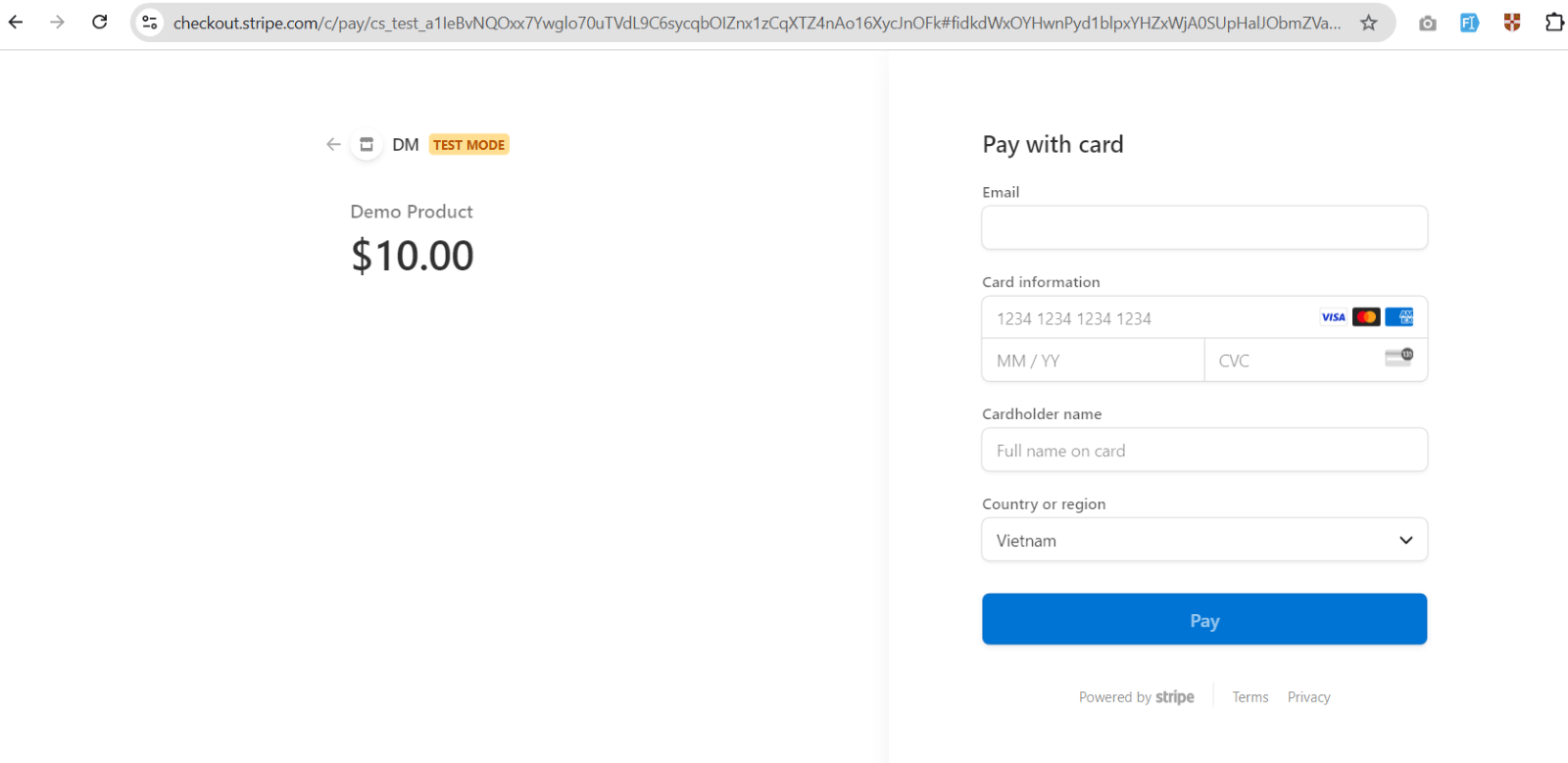

Create a Simple Frontend

- Inside resources/views/checkout.blade.php, add:

Serve the App

- Run:

- Go to http://127.0.0.1:8000/checkout and test it.

Handling Payments

- Successful Payments

Trigger order fulfillment and send confirmation emails.

Store payment details securely for future transactions.

- Failed Payments

Utilize smart retries and email reminders.

Implement dunning management to recover revenue.

Advanced Integrations

- Subscription Billing: Automate renewals, offer trials, and flexible billing cycles.

- Multi-Currency Support: Cater to global customers with localized payments.

- CRM Integration: Sync with platforms like HubSpot for customer management.

7. Case Studies and Examples

One-Time Payment and Recurring Billing

Stripe supports both one-time and recurring billing, enabling businesses to process transactions seamlessly. One-time payments are ideal for individual purchases, while recurring billing suits subscription-based models with automated invoicing and dunning management.

Small Business & Enterprise Use Case

- Small Online Store Example

A handmade products store integrates Stripe by setting up Stripe Checkout, webhooks for payment updates, and alternative payment options like Apple Pay.

- A handmade products store integrates Stripe by setting up Stripe Checkout, webhooks for payment updates, and alternative payment options like Apple Pay.

A handmade products store integrates Stripe by setting up Stripe Checkout, webhooks for payment updates, and alternative payment options like Apple Pay. A SaaS company leverages Stripe Billing for automated invoicing, Stripe Tax for compliance, and integration with accounting tools for financial tracking.

8. Future of Payment Processing with Stripe

As digital payments continue to evolve, Stripe is at the forefront of innovation, shaping the future of online transactions. Here’s a look at the key trends and what’s next for Stripe.

Emerging Trends

Digital Wallets & Alternative Payments

More consumers are using Apple Pay, Google Pay, and local payment methods, and Stripe is expanding support to keep transactions seamless.

AI & Blockchain Integration

Future developments may include AI-driven fraud detection and blockchain-based security enhancements for faster, safer payments.

Stripe’s Roadmap

New Features & Services

Expect improvements in subscription management, automation, and analytics to streamline payments.

Global Expansion & Strategy

Stripe is focused on making cross-border transactions easier, helping businesses scale without payment barriers.

9. Conclusion

Stripe isn’t just a payment processor—it’s a complete financial toolkit that helps businesses handle transactions with ease. Its developer-friendly API simplifies complex payment workflows, making it accessible for startups, enterprises, and everything in between.

With powerful features like multi-currency support, advanced fraud detection, and seamless integration with various platforms, Stripe enables businesses to scale effortlessly. Whether you’re selling products, offering subscriptions, or running a marketplace, Stripe provides the flexibility and security needed to stay ahead in the digital economy.

As online payments continue to evolve, Stripe remains at the forefront, constantly innovating to provide faster, smarter, and more reliable payment solutions. By choosing Stripe, businesses can focus on what truly matters—growth, customer experience, and expanding their reach in a global market.

10. Resources

Demo source code: https://github.com/mayphan/Stripe-Demo-Laravel