Customer from: Singapore.

Engagement model: fixed price.

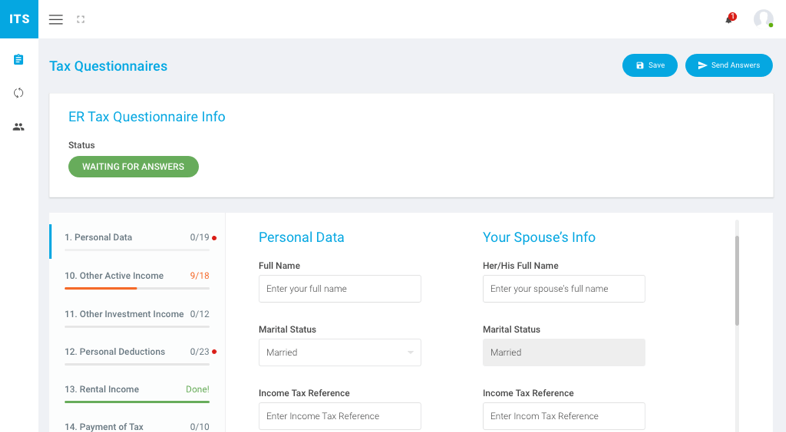

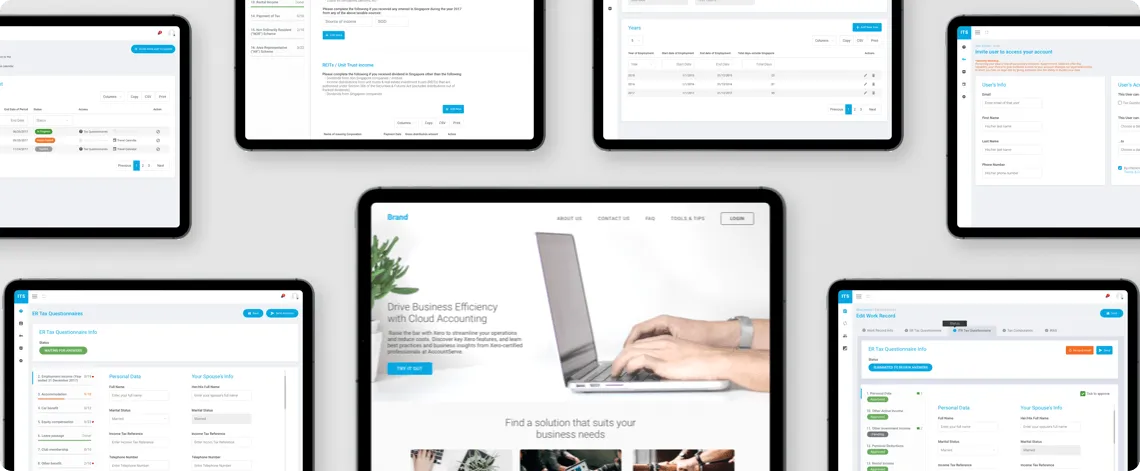

ITS – INDIVIDUAL TAX SYSTEM

What The Client Required

Customer from: Singapore.

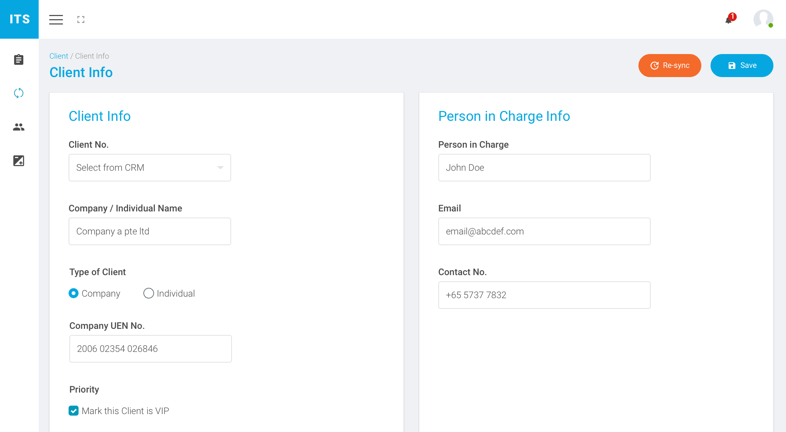

- CRM integration.

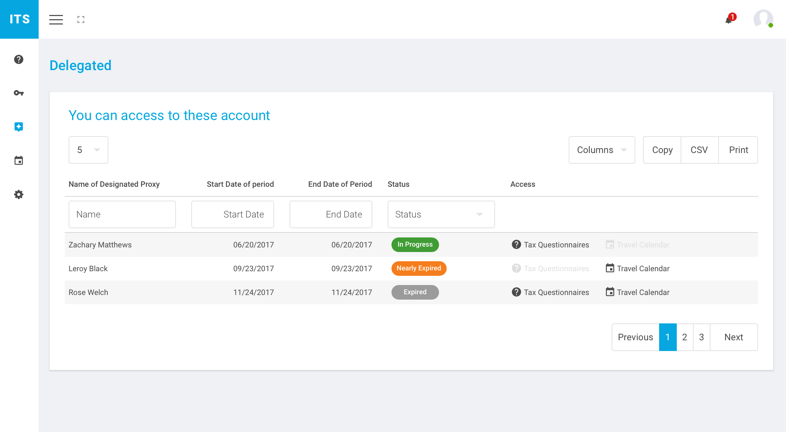

- Permission support to control fields visible, disable, or not for the different user roles.

- IRAS (Inland Revenue Authority Of Singapore) integration: submit XML file to IRAS: IR21; Form B1.

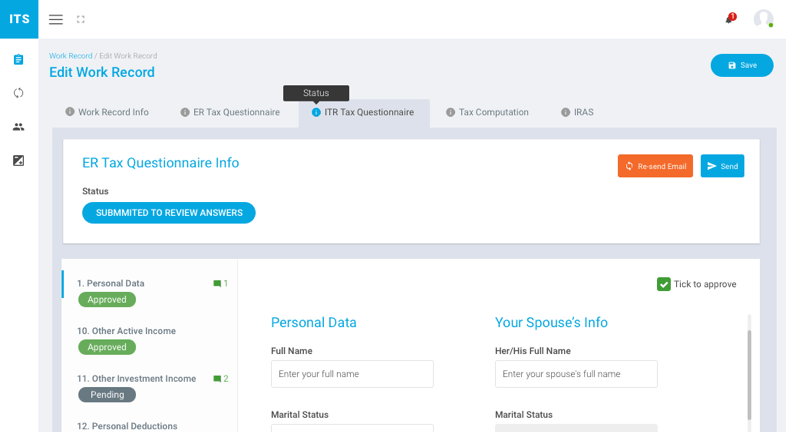

- Full Individual Tax Information - 16 Tax Questionnaire Sections for both Employee and Employer.

- Tax Computation: Multiple formulas by configurable and export results to PDF files.

Our Technologies

Specifically, the Saigon Technology team utilized the following technologies for the project:

- .NET Core 2

- jQuery DataTable

- Entity Framework Core 2

- Auto Mapper

- Fluent Validation

- Hangfire (Background Job)

- Swagger: Gen and UI

Challenges

- Many businesses inside.

- Tax Computation needs 100% cover all cases and the exact amount.

- Multiple currencies are supported.

Solutions

- Follow exactly existing herd copy of Tax Questionnaires.

- Refer to IRAS documents.

- Currency Rate use API from Monetary Authority of Singapore (MAS) (http://www.mas.gov.sg/)

- Do comparison testing to ensure tax computation result is correct.